For a half-dozen or so years, researchers around the world have been on a feverish quest—to make electronic devices last a lot longer, electric cars go much further, and renewable power a broader reality, all at an affordable price. But the prize has remained elusive. We are still frustrated by dead phones, and most people can’t afford a $132,000 Tesla.

Now, a flurry of Silicon Valley startups are reporting progress on one of the most confounding ideas under study: to make an electrode of high-energy silicon, the same material used in computer chips and solar panels. It’s a scientific holy grail that, if tackled, could help the industry achieve much of what it’s seeking.

None of the claims has been independently verified, and there are gaps in the data disclosed thus far. Skeptics, noting persistent shortcomings with silicon, suspect a new breakout of the hype that has dogged the battery field, and even engulfed a small handful of entrepreneurs in scandal. And the reported advances—even if they bear commercial fruit—seem likelier to power high-tech military drones than mass-market electric cars.

Yet, at a time when the first wave of longer-distance electric cars priced for the mass market is just months away, the assertions suggest renewed hope for hotly competitive battery research.

The craze certainly has gripped Wall Street, where a single tweet by Tesla CEO Elon Musk sent Samsung shares down a whopping 8% on June 7, wiping $580 million from its market value. What did Musk say? Merely that, contrary to reports, he would not be buying Samsung batteries for his much-discussed Model 3 mass-market electric.

The fate of giant multinationals like Samsung isn’t ordinarily subject to individual parts announcements, The Wall Street Journal noted, but “the Tesla effect,” as it called the phenomenon, is something different, often giving and taking away according to the electric carmaker’s whims. As if to underscore the point, it happened again the very next morning, when another Musk tweet sent Samsung’s share price back up 5%, this one saying that, while the company won’t outfit the Model 3, it may supply the Powerwall, Tesla’s battery for homes and businesses.

Lithium-ion has taken us far, but may be nearing its limits

Lithium-ion isn’t a single battery type, but a catchall for a family of formulations that create energy by shuttling lithium, which is the lightest metal, to and fro between a pair of electrodes. In the quarter-century since it was commercialized, lithium-ion has gone from powering Handycams to enabling smart phones, high-end electric cars, and—experimentally anyway—parts of the electric grid.

Researchers have gotten most of the way by manipulating the relative quantities of aluminum, manganese, cobalt, and nickel in the positive electrode, called the cathode, which has resulted in much more energy. Manufacturers like Tesla and LG Chemical have squeezed out even more energy through engineering and manufacturing tweaks.

These advances are not to be underestimated. Together, they are why General Motors will manage to leapfrog Tesla later this year in the race for mass-market car buyers with the Chevy Bolt, a $35,000 pure electric car that will go more than 200 miles on a single charge. Tesla says it will achieve the same price and distance capability next year with the Model 3.

But experts say that, while they expect lithium-ion energy density to climb at a 7% annual clip for some years, it will ultimately reach its limits. By then, if our devices and electric cars are to work as long as we’d genuinely like, and cost what we’d genuinely be willing to pay for them, battery makers will need to have moved on technologically to the next thing.

Just what that next thing will be preoccupies battery researchers everywhere. A primary school of thought is not to discard lithium-ion entirely, but to create a new lithium-ion battery, one that retains the advances already achieved, and creates a breakthrough on top of them. That breakthrough probably would be tied to the negative electrode, known as the anode, a place that amazingly until now has gone all-but ignored in the battery quest.

For a long time, researchers have tried to tame silicon

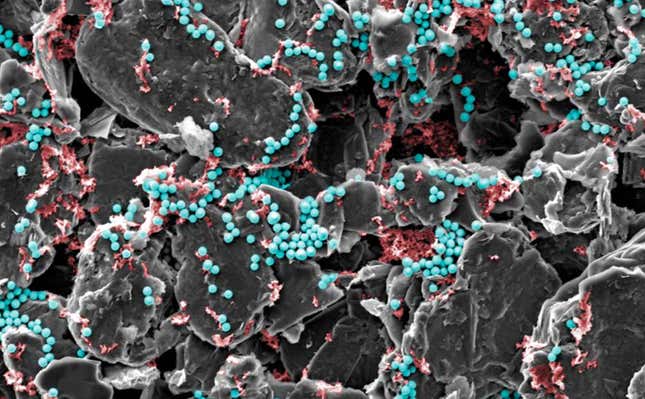

As of now, all lithium-ion anodes are made of graphite. But researchers know that if they could make an anode of silicon, or even 30% silicon, they would have a much more powerful battery. The reason is the physics. Graphite anodes store only one lithium atom for every six carbon atoms. Silicon anodes meanwhile can store up to 4.4 lithium atoms for every silicon atom. So a battery with a silicon anode would be able to shuttle far more energy-creating lithium than one with standard graphite.

Indeed, a silicon anode paired with a current state-of-the-art lithium-ion cathode could almost double the energy density of today’s commercial batteries, thus allowing them to be both much longer-lasting and cheaper. They would not not take us all the way to the envisioned objective, which is making stored electricity equal in price to fossil fuel-produced power, but it would be a game-changing advance.

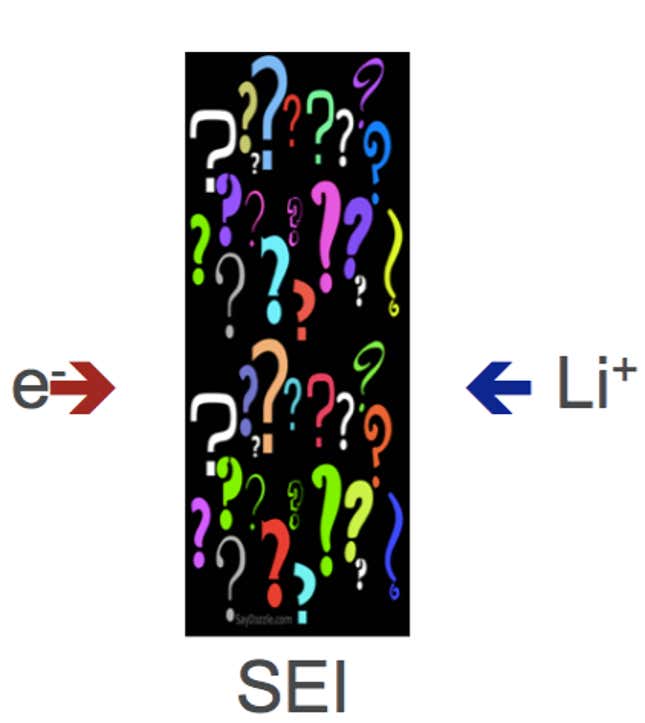

A problem with silicon, though, is that it swells up to about four times its size when it absorbs the lithium. When it does so, the anode shatters, and kills the battery. In addition, silicon is stubbornly resistant to performing one of the most important electrochemical reactions required of a lithium-ion battery: the self-formation of a protective layer around the anode to insulate it from the ravages of the liquid electrolyte. Absent this coating, known by the acronym SEI, the anode begins to dissolve into the electrolyte. After a single charge-discharge cycle, the capacity of the battery plummets. Researchers have a name for this. They call it catastrophic capacity loss, a term suggestive of how grave they regard the problem. “This is the problem,” said Robert Kostecki of Lawrence Berkeley National Laboratory.

Kostecki is a senior member of a four-dozen-strong SWAT team of battery researchers pulled together by the US Department of Energy (DOE) to work on silicon anodes so they can be used in electric cars. The three-year, $15 million project marks the second time the DOE has used this approach. In 2012, it formed a similar team of emergency specialists to try to fix debilitating flaws in NMC, a manganese-rich lithium-ion cathode that promised to vastly increase electric driving distance. Although the NMC team failed, a separate rescue attempt by LG Chemical found a workaround, and now its nickel-rich formulation of NMC has been embraced by GM and BMW, among others, and is a main force in the arrival of 200-mile electric cars.

The mood around the DOE’s silicon project, and silicon anodes generally, was grim at a week-long gathering of battery researchers in Washington DC this June. At one point during a presentation to the group, Kostecki put up this slide (above), reflecting what is known—or, rather, what isn’t—about the protective SEI layer around silicon anodes.

The SWAT team members say that for now at least, they are far from a solution that will put silicon anodes in cars. Yet, a small number of startup battery companies say they’re making progress with the technology.

These startups say they have fixed silicon

As of now, only one commercial lithium-ion battery has any silicon in it–the Panasonic cylindrical cells that go into Teslas. The Panasonic anodes contain an estimated 1% to 3% silicon, a minuscule amount that helps the batteries avoid catastrophic capacity loss, when they fail to form the self-protective SEI layer; but because they have some silicon, they achieve a bit more energy, and Panasonic gets to test out silicon in real-world situations.

But at least three California startup battery companies say they are on the verge of commercializing batteries with silicon anodes, too, only with much more of the element–two of them with 100% silicon anodes. All three say they have solved the problem of catastrophic capacity loss. One shared trick is loading extra lithium in the battery. This approach, what they call “prelithiation,” compensates for the loss of lithium that occurs in the first charge-discharge cycle. In addition to offering up this engineering solution, the companies are also embracing a new trend of finding economies on the factory floor, by reinventing how lithium-ion batteries are manufactured.

Here is what each of the three startups say.

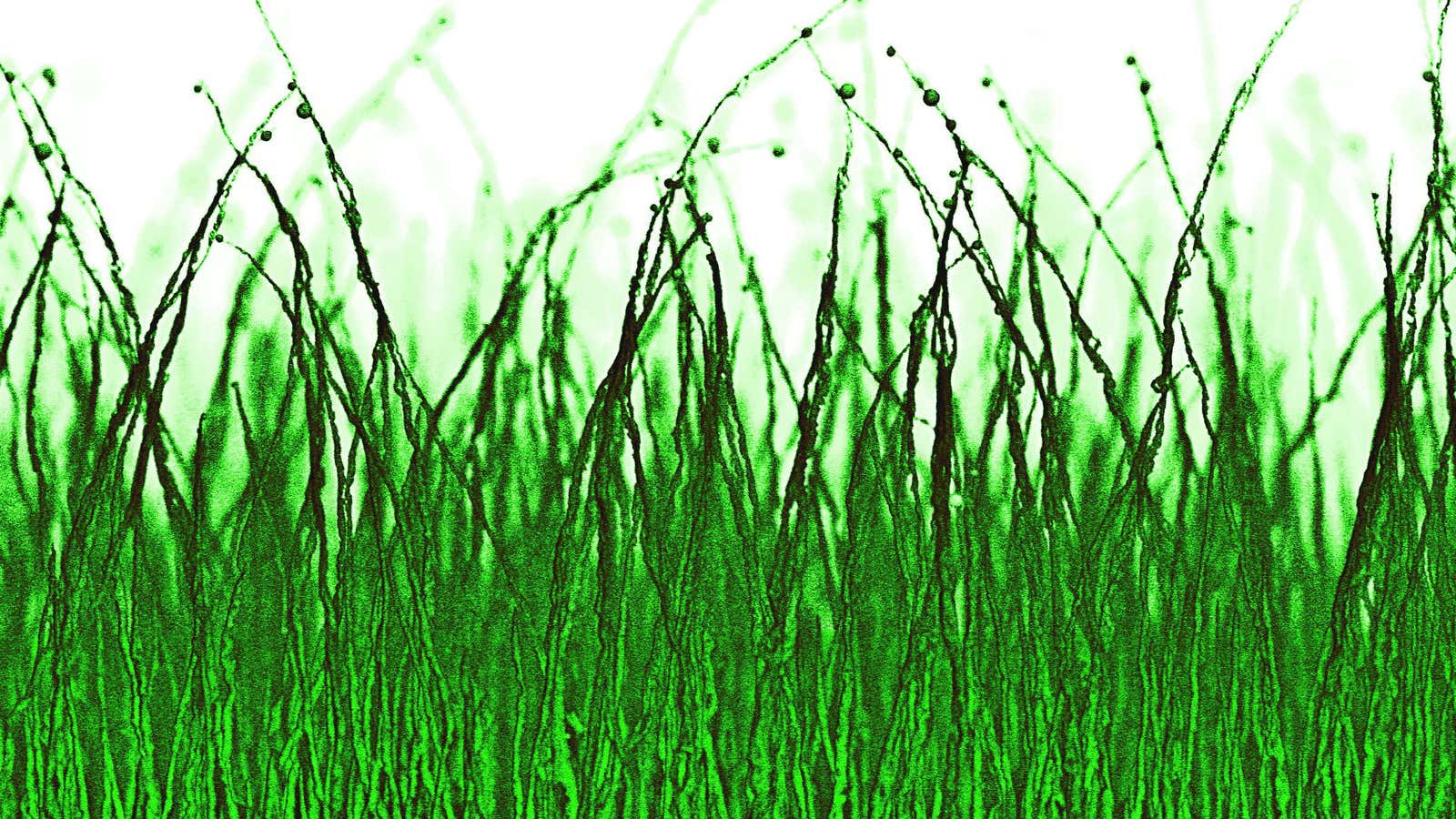

Amprius: For much of the last five years ago, Amprius has been one of the hottest battery startups in Silicon Valley, attracting $55 million in funding from some of the most illustrious names in venture capital, including Google’s Eric Schmidt and the firm Kleiner Perkins. Amprius sprang from the lab of Stanford University professor Yi Cui, an unassuming researcher who has attracted much media coverage for the outsized breakthroughs claimed by his team. His signature invention is the theoretical optimization of ”silicon nanowires,” strands less than a thousandth the diameter of a human hair that he proposed for use as anodes.

Cui’s struggle is that none of his top inventions has actually gone commercial. In the case of nanowire anodes, Amprius has said that its main challenge has been scaling up. But on June 29, Amprius will launch a pilot manufacturing line in the Netherlands as a first step to high-volume production of the anodes. Later this year, Amprius will attempt to raise a new round of funding in part to pay for this buildout. CEO Kang Sun says that the amount and timing haven’t been decided, but one source tells Quartz the sum will be on the order of $50 million.

The larger question around the technology remains cost. Amprius has modeled a cost of $125 per kilowatt hour once it is producing sufficient batteries for 100,000 cars; that is an accepted industry marker for the cost at which electric cars will be economically equivalent to gasoline-powered cars. But until Amprius releases data for current manufacture, the assumption will understandably be that its costs are not quite that impressive yet. Experts outside the company who are familiar with silicon and the manufacturing method Amprius uses (called chemical vapor deposition) estimate its current costs at $600 to $1,000 per kilowatt hour, or up to eight times the target.

Enovix: This Silicon Valley startup, founded in 2007, is backed by $100 million in strategic venture capital from Intel, Qualcomm, and Cypress Semiconductor. Chief technology officer Ashok Lahiri says a 100% silicon anode is placed in a battery architecture that absorbs the swelling and thus doesn’t shatter. Enovix’s costs, he says, are contained by the use of mature solar wafer manufacturing techniques.

As with Amprius, Enovix has only modeled and not demonstrated its first-stage costs, which it puts at $300 per kilowatt hour. What sets the company apart is its strategic partnerships. Cypress, through its SunPower solar subsidiary, has long used the precise same manufacturing system. And both Intel and Qualcomm appear to be potential Enovix customers down the road.

Envia: At last look, this East Bay startup was laid low by a fiasco with GM, which it had promised a 200-mile battery, only to lose its contract when its claims did not stand up to scrutiny. Almost four years later, Envia is back with a silicon anode that it reports is cycling well enough to deliver a battery for a smartphone customer next year. It is developing another battery configuration for use in drones. The company has not released cost figures, suggesting again that its products aren’t yet competitive on a price basis with conventional lithium-ion.

In his first public presentation since the GM debacle, Envia founder Sujeet Kumar, appearing May 24 before a group of researchers at Pacific Northwest National Laboratory in Washington state, spoke of silicon, while also directly addressing the dustup with GM. Kumar was said to be quietly defiant: The claims he made, most prominently in a 2012 public announcement of a breakthrough 400-watt-hour-per-kilogram battery, were justified, he said. Such a battery is possible, theoretically speaking, Kumar said. Only, such high-energy can’t hold up under the punishing conditions demanded by carmakers. With those constrictions, he suggested, everyone should understand that 350 watt-hours per kg is the practical limit for lithium-ion batteries, even with silicon anodes.

Given that current commercial electric car batteries are at best around 220 watt-hours per kg, that in itself would be a substantial advance.

So why is the rest of the battery community so gloomy?

How to explain the disconnect between the cheeriness of these startups and the ongoing skepticism within the battery field as a whole? Members of the DOE’s SWAT team note that while prelithiation does improve the performance of silicon anodes, it’s not a complete solution. If it were, the startups and everyone else would already be achieving the goal of cycling a silicon anode battery 1,000 times.

But the main disconnect here is the definition of success: When the startups are announcing their advances, they appear to mean breakthroughs that will let them install their batteries in drones and small wearable electronics like watches. They say they’ll soon be doing that. And maybe, maybe down the road, they can try tackling electric cars.

But the rest of the field regards niche markets like drones and wearables as comparative child’s play. To them, real success means supplying attractively priced electric cars with an economically produced power source, and providing backup energy storage for utility-scale grid electricity. So for now, the SWAT team remains actively engaged.