Yes, Millennials Are Cheap—and This Graph of the Teenage Budget Explains Why

When you don't have to pay mortgage or own a car, life gets cheaper

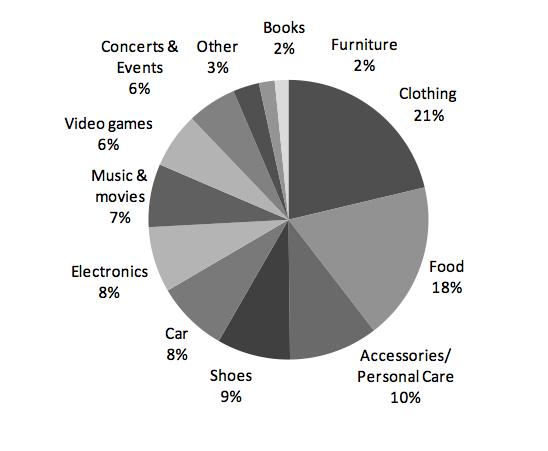

When Piper Jaffray last surveyed teenagers to learn how they spend money, they got this:

Nobody ever said it was easy being a teenager, but, man, does this make it look fun. Clothes (including shoes), electronics, movies, music, video games, concerts, accessories, food: That is the life. And together, it makes up about 70 percent of the teen budget.

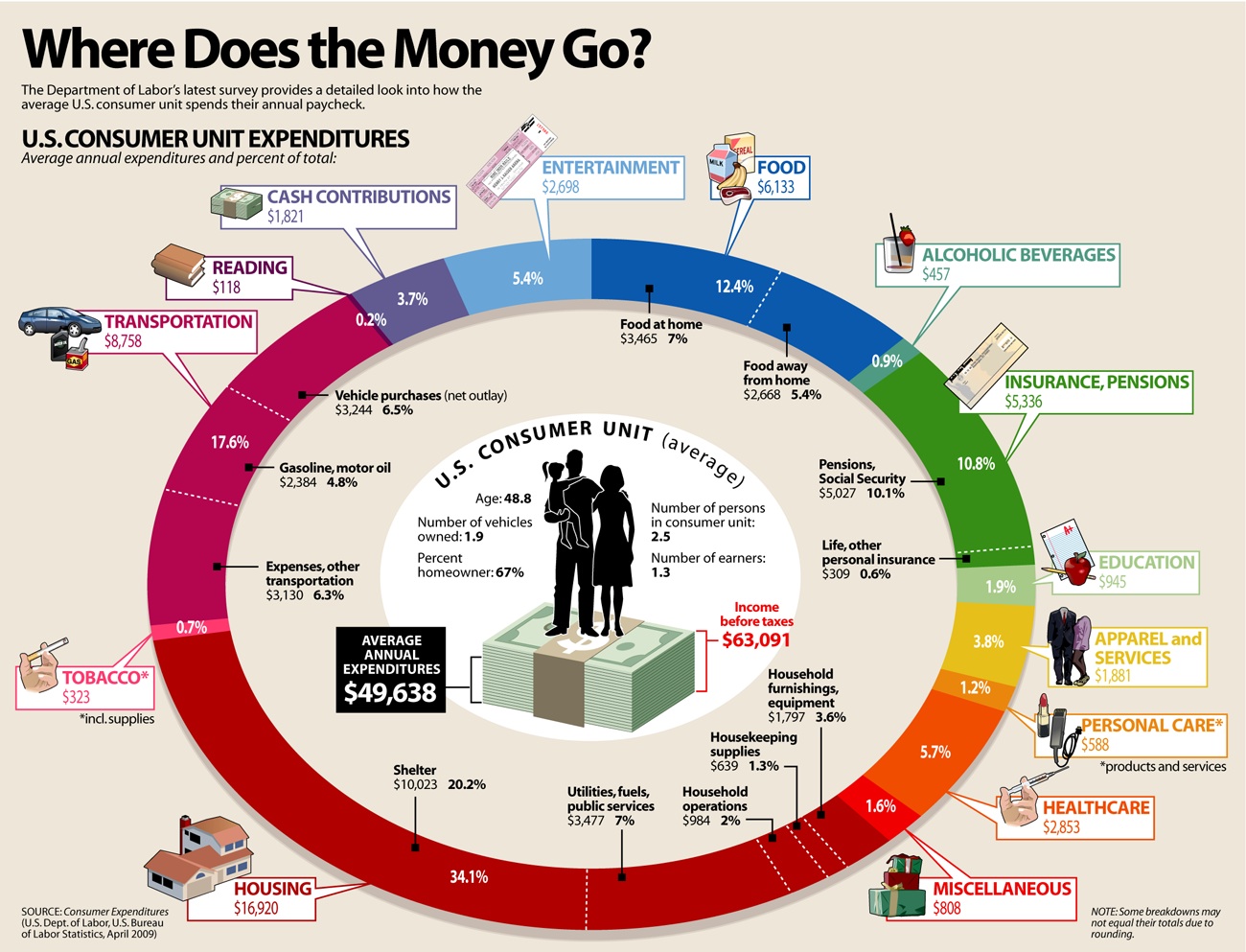

Half a century ago, the difference between the teenage budget and the young adult budget, seen below in 2009, was vast. Teens don't have much money, because they scarcely work, but they can still "afford" to spend on luxury goods—shoes, jewelry, concerts—because they don't have to pay for the things that actually cost money—homes and insurance.

But in the last few years, the young-adult budget has moved away from the adults and toward the young. Twentysomethings, graduating into a recession-bit economy, have less money, and they're putting off, or giving up, on things like cars and houses.

Some economic analysts consider it a mystery that this recession generation can't afford houses and cars, yet somehow manages to afford iPhones and constantly dine out. But if you understand the young adult budget through the teen budget, it's not a mystery at all. If you don't own a house, or drive a car, or have layers of insurance for your family (because you don't yet have one), life is much cheaper. Not cheap, but cheaper. And it creates opportunities to build your own economy around things like mobile technology and restaurants.