I think the answer is a strong “no,” but I did want to address this topic nonetheless…

In this post:

The theory for American Airlines’ bankruptcy

CCN published a story yesterday titled “Fasten Your Belts, American Airlines Investors: You’re Flying Into Another Bankruptcy.”

The argument for American Airlines apparently being headed into bankruptcy comes down to a few things:

- American Airlines filed for Chapter 11 in 2011, and many of the same factors — high debt and labor disputes — are still present now

- American is more leveraged than they were during their last bankruptcy — at the time they had liabilities of $29.55 billion, while now American has about $34 billion in debt

- American has way more debt than competitors — United has $20 billion in debt, Delta has $17.4 billion in debt, and Southwest has $4.6 billion in debt

- American’s bonds are at near distressed levels, with some bonds yielding over 12%

American management doesn’t seem worried

Just two days ago, American Airlines CEO Doug Parker presented at the JP Morgan 2020 Industrials Conference.

It’s interesting to compare the level of alarm we’re seeing from US airline executives. United President Scott Kirby is taking a doomsday approach to the current situation, noting that he’d rather the airline responds too much rather than too little.

Meanwhile American CEO Doug Parker seems to be taking more of a “we’ll be fine” approach.

Some highlights include:

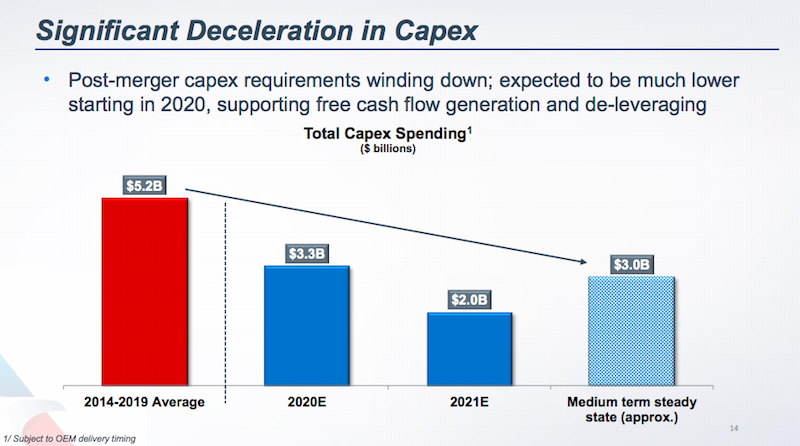

- American’s significant deceleration in capex starting in 2020; in 2014-2019 they averaged $5.2 billion per year, while by 2021 they’re estimating just $2.0 billion

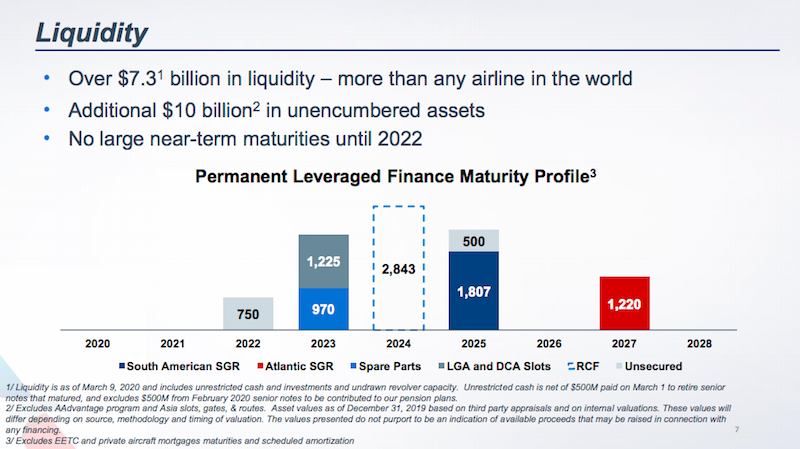

- American has over $7.3 billion in liquidity, more than any other airline in the world

- American has an additional $10 billion in unencumbered assets

- American has no long-term maturities until 2022

Again, let me note that the above is all Parker’s perspective on things.

My take on American’s situation

Look, it’s no secret that I don’t have a love affair with American’s management. I thought it was laughable when Parker said that the company would make a minimum of $3 billion in profits per year, even in bad years.

But I think it’s way too early to suggest that American is headed for bankruptcy. There are a few considerations here:

We don’t know how long the current situation will last

It goes without saying that American may eventually be in trouble, just as all airlines may eventually be in trouble. These are truly unprecedented times. I would imagine all US airlines can weather this situation for several months (the same probably isn’t true for at least a handful of fairly large non-US airlines).

But how long will this last? Will the world go into lockdown for a few weeks? For a few months? For a few years?

This seems like more of a question for scientists and doctors than for Wall Street (and I’m none of those things), and even those who know the most have varying opinions on how this will develop.

Airlines are in a different position than a decade ago

As much as consumers might not like US airlines, I think there’s no denying that they’ve fundamentally transformed since the last round of bankruptcies.

Between denser and more fuel efficient planes, better revenue management, more efficient route scheduling, etc., airlines are in a better position.

Parker gave the example of how in both 2005 and 2015, the price for oil was roughly $55 per barrel. Yet in 2005 the industry lost roughly $28 billion, while in 2015 the industry earned roughly $19 billion.

While we might not like some of the changes as consumers, the industry has come a long way.

Low oil prices help

Oil prices are in free fall, and that certainly helps airlines a lot. Of course low oil prices help more when there’s lots of demand for air travel, but at least American’s variable operating costs will be lowered…

I don’t think labor will be as much of an issue

American does have big contract negotiations ahead with both pilots and flight attendants, after wrapping up negotiations with mechanics. Call me naive, but I get the sense that there might at least temporarily be more of a “we’re all in it together” spirit now compared to 2011, when American was in bankruptcy.

The coronavirus situation truly is unprecedented, and I think even the otherwise tough unions might be a bit patient, or at least I don’t think this would be an issue that somehow pushes American over the edge.

Again, that might be naive on my part, but I don’t view labor as being the biggest challenge for American at the moment.

Bottom line

Of course airlines are in a really bad position right now. Furthermore, among US airlines, American has the highest debt by far. Still, I don’t think American is anywhere close to filing for bankruptcy, and I don’t think simply comparing 2011 debt levels to 2020 debt levels tells us all that much.

The industry has come a long way in transforming, and that includes American. What none of us really know is how long the impact of coronavirus will be felt in the airline industry (or perhaps the global economy on the whole).

What do you make of the claim that American is at risk of bankruptcy?

Unless I missed it, the glowing view of American Airlines management leaves out the "greed" factor that exposes a total disregard for sound, financial and fiduciary responsibility: stock buybacks since 2014 to the tune of $12.4 billion. Think competent, responsible executives would have said "let's hang onto this because we learned our lesson in 2008. And no self-serving buybacks." Could American use unencumbered, non-loaned $12.4 billion just about now? Much better to grab profits via...

Unless I missed it, the glowing view of American Airlines management leaves out the "greed" factor that exposes a total disregard for sound, financial and fiduciary responsibility: stock buybacks since 2014 to the tune of $12.4 billion. Think competent, responsible executives would have said "let's hang onto this because we learned our lesson in 2008. And no self-serving buybacks." Could American use unencumbered, non-loaned $12.4 billion just about now? Much better to grab profits via inflated stock prices short-term than plan for the future of almost 130,000 employees. (Let's leave out the plethora of customers who will be stuck with worthless miles and vouchers should/when AA goes belly-up.) It's a pity the American public isn't educated on how executives really "manage" money coming in from profits, loans and bail-outs. It might make them wiser as well as sick.

I purchased American Airlines shares this morning at $ 11.50 a share.

My total investment was $417,500.00. I will wait & review my return in 2-5 yrs . Hopefully we found a vaccine in a year or 2 .

Donald Trump said that he will back up the airline industry. If he did not say that I would say 99%, they will go to bankruptcy. Donald Trump is a big factor. I am sure Warren Buffet does not want to lose all his investments as well in the airline industry. They just want to see the prices low as much as possible and buy them all for sky rocket profit. Cash is the king....

Donald Trump said that he will back up the airline industry. If he did not say that I would say 99%, they will go to bankruptcy. Donald Trump is a big factor. I am sure Warren Buffet does not want to lose all his investments as well in the airline industry. They just want to see the prices low as much as possible and buy them all for sky rocket profit. Cash is the king. Probability analysis is showing that the price will be below at $4.05 for August 21, 2020 at the 70.04% probability.

Hopefully, they will find the standard treatment until then. I am very optimistic they will find it until August.

@Sandgrounder54 I asked the same thing too. I didn’t get a reply. I’m wondering that myself. Hopefully if that happens (which I seriously doubt) we’ll have to either quickly book to travel somewhere in the travel-ban-lifted future with an airline that’s not going under, or we’ll have to unfortunately quickly buy something through the online store. Hopefully it doesn’t come to that.

I know this is not the most important questions, but, ahem, what do we think would happen to our Advantage miles if American went bust?

I believe American was the airline most exposed to the 737 Max saga. They really needed the planes. Which means they were flying a lot of old planes. The drop in demand means they can now retire these planes without giving up market share and by the time demand comes back the 737 Max will be ready . So it seems that 2 problems have cancelled each other out and as a bonus AA has cheap aviation fuel.

I think there will be a coordinated bail out of the airlines by the middle of the week. The fact that AA has unpledged assets is irrelevant as they will not be able to borrow against them in this market. They have cash and short term facilities but the banks will halt the facilities. It is a liquidity issue right now and Governments can provide sufficient liquidity very quickly at no financial cost. If a...

I think there will be a coordinated bail out of the airlines by the middle of the week. The fact that AA has unpledged assets is irrelevant as they will not be able to borrow against them in this market. They have cash and short term facilities but the banks will halt the facilities. It is a liquidity issue right now and Governments can provide sufficient liquidity very quickly at no financial cost. If a major airline files there will be financial contagion risk...that is why there will be a bailout and soon.

Let me use my last 15k miles first, then it's ".....so long dearie" as far as I care about AA.

Ben can write what he wants - it's his blog. Don't like the content? Go start your own and see if you can get near his success level. Some of the comments over the past few weeks have been ridiculously rude and elitist. You are still talking to a person, not a computer. Remember respect.

Just my opinion.

First, my Investment firm, one of the (many) best has changed their opinions 3 times this week as the situation unravels. There is no such thing as TMI. Discussing opinions is positive, not the act of someone hanging up a fake diploma. We all have opinions and we do not have a crystal ball.

I myself am a UAL investor. I am not "deeply" concerned because:

- UA is still operating, albeit at a...

First, my Investment firm, one of the (many) best has changed their opinions 3 times this week as the situation unravels. There is no such thing as TMI. Discussing opinions is positive, not the act of someone hanging up a fake diploma. We all have opinions and we do not have a crystal ball.

I myself am a UAL investor. I am not "deeply" concerned because:

- UA is still operating, albeit at a loss. Remember the days when Airlines ran up whopping losses many years in a row?

- Oil prices are low, very low, UA's largest cost.

- The loss of so many International routes hurts but does not kill.

- Corona Extreme will likely be short lived with a long tail to the bell curve. During the latter there will, be pent up demand, mainly business but some leisure as well.

- The US government will not permit the USA to have not have flag carriers. It is a source of pride and also government security. It functions as an extension/contractor of USAF

- The Chase effect continues whether folks fly or not. I earned miles at lunch.

So, to quote Alfred E. Newman, "What me Worry?"

The 737 MAX was grounded 1 year ago, March 10. This will probably help American go south as Boeing hasn't posted updates for a while, looks like everyone forgot. idk

Guess you haven't talked to many AA pilots. They definitely aren't in it together. The loan is due.

@Eskimo - American has loan covenants that require a minimum $2 billion cash balance as well.

This is a decent analysis. Definitely could be wrong, but there is nothing obviously dumb about it. The "lucky should only write about this" crowd needs to go away. Lucky should write about anything he wants, because he is smart and well informed.

That said... if you want to invest... hotels>airlines. But you wont get the same leverage as these, at some point airlines will price as options, and maybe go bk. Too early...

This is a decent analysis. Definitely could be wrong, but there is nothing obviously dumb about it. The "lucky should only write about this" crowd needs to go away. Lucky should write about anything he wants, because he is smart and well informed.

That said... if you want to invest... hotels>airlines. But you wont get the same leverage as these, at some point airlines will price as options, and maybe go bk. Too early still though, reality is that this happened to a historically over valued market, we have more to go to hit deep value.

The feds will try, but they can't bail out every industry, and this time every industry will be hurt and asking.

@Tim

Lucky is a travel blogger, not an investment analyst. He's not qualified to address whether American Airlines or any business is going to go out of business.

@Reginald pretty condescending, it's his right to state his opinion. No need to tell him to be quiet about a particular subject. If you disagree, argue his points not his existence.

A little off topic, but does anyone think if the US implements a travel ban in Washington state, Alaska Airlines could be the airline that goes bankrupt? I know it's a big "if", but Trump has floated the idea, or at least said it's possible. I don't know the numbers, but Alaska is HEAVILY dependent on SeaTac, whereas the big three and even Southwest are much more diversified geographically.

The thought alone makes me sad,...

A little off topic, but does anyone think if the US implements a travel ban in Washington state, Alaska Airlines could be the airline that goes bankrupt? I know it's a big "if", but Trump has floated the idea, or at least said it's possible. I don't know the numbers, but Alaska is HEAVILY dependent on SeaTac, whereas the big three and even Southwest are much more diversified geographically.

The thought alone makes me sad, but generally these types of troubled times for airlines lead to somebody becoming insolvent and assets acquired right? If American doesn't go bankrupt themselves, they may even be the ones to scoop up Alaska Air.

Just a thought, and a sad one at that :(

@Magellan

+1

@Brent Is Sam Chui really the most reliable person?! He's the same on that makes sexually suggestive remarks on flight attendants. Total creep.

Completely wrong. The question is not when their debt matures, the question is how much cash they burn when they are not flying. As Boeing has demonstrated recently, you can burn through $7 billion in cash extremely quickly, when no one is buying your product.

Boeing, by the way, was down 20% in the last three hours of trading today. It lost $15 billion of market capitalization in three hours.

Be very, very careful making these kinds of assumptions and statements. This kind of analysis is way over the heads of the average observer. Lehman's CEO was producing confidence inspiring presentations that fooled sophisticated finance whizzes up until 5 minutes before they declared bankruptcy. AA stock is in peril and unless you have inside information, you will most likely get burned hard. And if you do have inside information, you can't trade on it legally...

Be very, very careful making these kinds of assumptions and statements. This kind of analysis is way over the heads of the average observer. Lehman's CEO was producing confidence inspiring presentations that fooled sophisticated finance whizzes up until 5 minutes before they declared bankruptcy. AA stock is in peril and unless you have inside information, you will most likely get burned hard. And if you do have inside information, you can't trade on it legally anyway.

China has seen an 85% reduction in air travel no doubt US will eventually see this as well . basically no airline can withstand the market collapse that this will bring - except freight carriers.

This will continue for quite some time - the wishful thinking by June everything will be alright is just a fantasy dream.

Depending upon how long - we may well see an "Amtrak of the skies"

I see some bargains on miles for sale. Now if you can ever find a saver type seat in business/first, that will be another story. Of course that will only raise millions and not billions.

Is AA still cracking down and closing FF accounts?

@Mr. G - There reporters. If their field starts to collapse, they will have something to report on. Just take a look at the Coronavirus dominated news stories on every blog. Perhaps, this situation actually brings in more viewers ;)

I don't side with Trump much but CCN is a hack news organization. They read the internet (this story was floating around FlyerTalk for a few weeks now) and they think it's news. I miss reporting and opininating!

It is far too early to try to pick winners and losers but remember that all of the debt that is taken on will have to be carried for years to come; loading up on debt to avoid bankruptcy now could be highly problematic.

Airlines - and plenty of companies in other industries - that were in bad or risky shape before the virus crisis will be at risk now.

There is no assurance that "domestic only" airlines will fare any better either.

So what's the future of our AA miles? Should we try and use them (although flying anywhere right now is near impossible)? Should we keep them and hope that either things recover or that even if things go 'south', AA will still be around?

Never underestimate the power of an old-fashioned, special interest fueled government bailout.

That what's coming and and I don't know about you, but I can't wait to see what densification that my tax dollars are going to fund.

It's how we roll. God bless 'merica.

@dan... Try QANTAS and not quantas

@Gary Leff

1. Technically UA had 4 +2 loan +2 credit.

2. The 2bn credit will disappear if covenants are not met.

3. The 2bn loan will be called if covenants are not met.

All of this was BEFORE Trump banned EU.

So I don't think UA does have 8bn in liquidity. I think UA is also in a pretty bad shape.

Full disclosure, I invest in these airlines and all I can...

@Gary Leff

1. Technically UA had 4 +2 loan +2 credit.

2. The 2bn credit will disappear if covenants are not met.

3. The 2bn loan will be called if covenants are not met.

All of this was BEFORE Trump banned EU.

So I don't think UA does have 8bn in liquidity. I think UA is also in a pretty bad shape.

Full disclosure, I invest in these airlines and all I can say it's like flipping coins now. Every new policy can bankrupt any airline now. As of today, I'm not sure we will see the same AA DL UA in a year or not.

Too soon to say but AUAL and DL maybe? We can celebrate Scott and Doug back in bed together?

Lol well thanks for all the free money, just out here buying puts on every airlines and cruise ship operator

I just read that Air France is planning to operate to most destinations in the US and requested to continue service to Boston , Houston and Miami

Swiss and Lufthansa on the other hand will only fly to Chicago and Newark.

There are around 800 return flights daily between Europe and the USA over 200,000 seats Potentially over 30 days - 6 million

Maybe a competent airline like Southwest will buy them.

American would never go under. They survived 9/11. The stock was at $3 in 2003. This is nothing new it’s all cyclical. Look at the price of gas ? They will reup.

Rule #1 of investing: avoid airlines, banks, and oil industry

Rule #2 of investing: remember Rule #1

Lucky, no offense, but you just aren't qualified to write competently on this subject. You're a travel blogger and I enjoy what you do, but stay in your lane please.

"American has over $7.3 billion in liquidity, more than any other airline in the world

American has an additional $10 billion in unencumbered assets"

1. United actually has more liquidity than American (over $8 billion). When American made this presentation they believed themselves to be accurate but were unaware of additional cash United had accessed.

2. The value of American's unencumbered assets are certainly much lower than when they were marked to market at...

"American has over $7.3 billion in liquidity, more than any other airline in the world

American has an additional $10 billion in unencumbered assets"

1. United actually has more liquidity than American (over $8 billion). When American made this presentation they believed themselves to be accurate but were unaware of additional cash United had accessed.

2. The value of American's unencumbered assets are certainly much lower than when they were marked to market at $10 billion.

We don't yet know how long this will endure, but American will have to take action to cut costs rapidly and conserve cash.

The fact that AA management is not worried is actually a contrary indicator. It means they are smoking something.

AA declares chapter xi by summer. All but a certainty

Honestly, I'd be more worried about United and Delta short term. Yeah, They don't have high debt but they are way more hurt by what is going on. Deltas main Asian hub/partner Korean Air is likely going bankrupt this year. Their KLM/Air France Paris and Amsterdam hub are now severely crippled by this 30day ban. United was heavily exposed to Asia and their partner Lufhthansa is in free fall at the moment - this ban...

Honestly, I'd be more worried about United and Delta short term. Yeah, They don't have high debt but they are way more hurt by what is going on. Deltas main Asian hub/partner Korean Air is likely going bankrupt this year. Their KLM/Air France Paris and Amsterdam hub are now severely crippled by this 30day ban. United was heavily exposed to Asia and their partner Lufhthansa is in free fall at the moment - this ban won't help. American depends on Japan Airlines and Quantas as Asian/South Pacific partners and so far are not as severely disrupted as United and Delta partners. This Europe ban is beneficial to British Airways and American flying people to Britain and them connecting on BA. United and Delta offer lots more luxuries than American to get high money clients but those will be chopped if have to to save money. We all know Americans product is bare as it is now but it allows them to offer cheaper prices. Will the lack of luxuries at Delta and United still be worth the higher price if American flies the same route cheaper? We are definitely headed into a recession and high paying clients will dwindle. American is basically the Frontier of the 3 big airlines but if they can fill seats and have robust network for business clients trying to save money, i think they will be okay. It's going to be a terrible next few years for them and all of them, but as my dad always said, "Its easier to go up in life and status than it is to come down" - DL offers great onboard product and when the economy is good and money is flowing we can be picky. But both United and DL have very high costs to deliver those products and can't be sustained in recessions. People and businesses trying to just get somewhere cheap in a recession are more likely to pick Southwest, American, Spirit, Frontier. Tele-conferences are going to be the new normal after this passes and those lucrative business clients won't be as plentiful.

I sold a lot of stock this morning. Capital reinvestments. Reprioritizing. I ditched Alaska and Boeing. I needed some losses. And when they start to recover, I can buy as they starting getting bullish again.

@Lucky Might be a few travel bloggers going out of business as well!

Lockdown won't be several years. Travel sentiment should be back to normal levels (100%) when anti-viral treatments and vaccines arrive - Summer 2021? Majority may feel comfortable boarding planes when infection rates decline - hopefully 3-5 months. However, if there's economic damage from a prolonged fallout/lockdown, demand could be soft for awhile. This is sort of like a 9-11/mild 2008 economic crash combo punch for the airline industry!

Seems AAs main Intl hubs are not listed on the airports that will be allowed to have flights to/from Europe MIA,PHL,CLT while DL and UA will have their Main hubs still operating

The stock price begs to differ.

You’d be surprised at how quickly these airline models burn cash. -15% RASM and cutting ASMs 10% with relatively fixed non fuel cost structures for 3 quarters can consume an immense amount of cash. Even without major debt maturities, AAL needs access to credit to keep the boat afloat. In 2008 credit lines dried up, so AAL could get stuck with some unfavorable terms. But Nevertheless I agree with you: no they won’t go bankrupt...

You’d be surprised at how quickly these airline models burn cash. -15% RASM and cutting ASMs 10% with relatively fixed non fuel cost structures for 3 quarters can consume an immense amount of cash. Even without major debt maturities, AAL needs access to credit to keep the boat afloat. In 2008 credit lines dried up, so AAL could get stuck with some unfavorable terms. But Nevertheless I agree with you: no they won’t go bankrupt because between Capex deferrals, encumbering their aircraft with EETCs (even at low LTVs), and returning aircraft, they should be able to survive a brief lapse in demand.

But if we had a full blown recession that lasted two years, no AAL wouldn’t survive (hopefully this is a wake up call to management after they clearly make less then 3B in profits)

Sam Chui sure seems to think they are at risk.