Financial services firms and credit unions manage large volumes of customer data, yet much of it stays siloed within legacy workflows. QR Codes and short links address this challenge by capturing real-time scan and click metrics that reveal actionable insights about customer interactions and touchpoints.

When you connect this data to your CRM or Salesforce systems, it streamlines automation and personalizes digital experiences while helping your business build trust and improve customer engagement. Bitly’s SOC-2–audited data platform allows financial services providers to optimize campaigns with secure and compliant data strategies. In this article, you’ll learn how leaders in the financial services industry can use scan and click data to deliver personalized experiences that strengthen customer satisfaction and drive the bottom line.

Note: The brands and examples discussed below were found during our online research for this article.

Why personalization is critical in financial services

Personalization has become essential for financial services firms that want to meet modern customer needs and stay competitive. Customers now expect every interaction to reflect their individual goals, financial behaviors, and preferred touchpoints. Whether they are managing investments, applying for insurance, or seeking advice on wealth management, they demand digital experiences that feel seamless and relevant.

Fintech providers and digital-first banks have raised expectations across the financial services industry by using automation and real-time customer data to deliver personalized experiences that build trust and improve satisfaction. Traditional financial institutions must now optimize their workflows and data models to keep pace.

By connecting scan and click data with CRM systems and dashboards, firms can transform transactional data into actionable insights that increase engagement and strengthen loyalty.

The role of scan and click data in personalization

Scan and click data give financial services firms a direct line to understanding how customers interact across digital experiences. Every QR Code scan and short link click produces first-party engagement data that reveals real-time details such as location, device type, and UTM tracking trails. This information can help your team uncover meaningful patterns in customer behavior.

The challenge for most enterprises lies in connecting this customer data to existing CRM, Salesforce, and marketing automation systems. Bitly’s data platform unifies scan and click data across channels, streamlines workflows, and transforms fragmented data sets into a single source of actionable insights. The pre-built integrations available on the Bitly Marketplace make it simple to pipe this information directly into your existing tech stack, and our open API lets you build any custom solution you need to get the most out of your existing workflow.

From anonymous activity to actionable insight

When financial institutions capture and organize scan and click data, they can link anonymous interactions to meaningful segments such as new versus returning customers, product interest, or regional behavior. This process turns disconnected metrics into a structured data model that powers more informed decisions. As a result, banks, insurers, and asset management providers can shift from broad messaging to precision targeting that enhances the customer experience and drives the bottom line.

Key personalization strategies using QR Codes and short links

Personalization in the financial services industry depends on the ability to deliver relevant messaging at every stage of the customer journey. By combining QR Codes and short links with automation and CRM integrations, you can use real-time data to optimize engagement strategies and strengthen relationships. These tools provide actionable insights that help your firm streamline workflows, meet customer needs, and improve overall customer satisfaction.

Channel-specific engagement

You can personalize outreach across email, direct mail, branch signage, and mobile banking channels using QR Codes and short links. Each scan or click reveals customer interactions that help refine future campaigns. Branded links enhance transparency and build trust, ensuring that customers always know they are engaging with a legitimate financial services provider.

Geography and device targeting

QR Codes for finance can deliver location-based scan data, allowing banks and credit unions to tailor promotions to local markets or showcase branch-specific services. Device-based insights make it easier to optimize mobile app flows and digital experiences for better user experience and engagement.

Customer lifecycle and account segmentation

Personalization value increases when tied to lifecycle stages. Financial services firms can deliver distinct messages for prospects, new customers, and high-value account holders. For example, they can use engagement data to upsell loans, insurance, or investment solutions. This approach turns every scan or click into a step toward deeper customer engagement and stronger bottom-line results.

Real-world use cases in financial services

Personalization becomes most effective when it connects real-world touchpoints with measurable data. Across the financial services industry, scan and click data can help financial institutions understand customer interactions in real time and design digital experiences that meet specific customer needs. From retail banking to insurance and wealth management, these insights create a foundation for continuous optimization.

Retail banking

Retail banks can use QR Codes on statements and direct mail to guide customers toward personalized digital experiences. Short links embedded in SMS or email messages can direct users to prefilled loan or credit card applications based on existing transactional data. These approaches streamline onboarding, reduce friction, and increase customer satisfaction.

Insurance and claims

QR Codes can enable customers to scan and submit claims through secure mobile-first workflows. Personalization can ensure each form comes prefilled with policyholder data, simplifying processes for both customers and providers. Bitly’s platform supports these initiatives through workflows that unify data sets and build trust at every stage of the process.

Wealth management

Wealth management teams can use scan and click data to measure engagement with investment reports, webinars, and retirement planning tools. Advisors can review dashboards that display metrics for each client segment and use this data to inform personalized outreach. It might surprise you how financial advisors can use Bitly to measure client engagement and drive positive user sentiment by personalizing messaging based on individual goals.

Addressing security and compliance concerns

Security and regulatory compliance remain top priorities for financial institutions and fintech providers that handle sensitive customer data. You might assume that scan and click tracking exposes information or creates risk, but the reality is the opposite. When built on a secure data platform, QR Codes and short links can enhance governance, transparency, and trust across every customer interaction.

Bitly uses encryption, HTTPS redirection, and Dynamic QR Code controls to help you minimize exposed security risk surfaces. These features ensure that every scan and click happens within a compliant, secure environment that meets the standards enterprise-grade financial services firms demand.

Bitly SOC-2 compliance verifies that our infrastructure supports rigorous data protection, access control, and audit processes. To maintain trust and integrity, financial institutions should adopt governance best practices such as role-based permissions, audit readiness protocols, and a centralized dashboard that manages all link and QR Code activity.

This framework not only safeguards customer data but also streamlines compliance workflows, helping your firm optimize personalization initiatives while meeting regulatory requirements.

How Bitly enables secure, scalable personalization

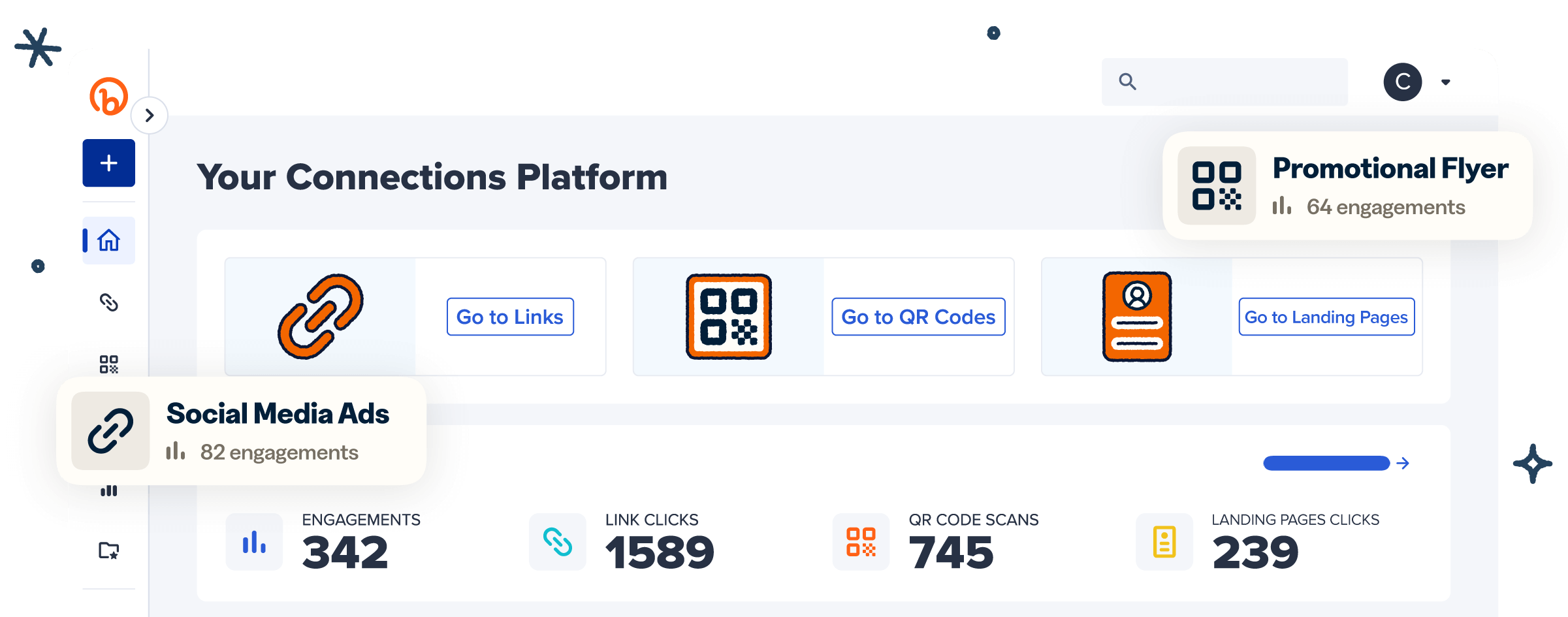

Bitly provides the secure data foundation that financial services firms need to personalize experiences at scale. Our platform combines branded short links, Dynamic QR Codes for finance, and the Bitly Analytics dashboard to give you full control of your customer data and engagement workflows. These features streamline operations, reduce siloed systems, and transform real-time engagement data into insights you can use.

Through seamless integrations with CRM systems, BI platforms, and APIs, Bitly enriches customer profiles with scan and click data from every channel. You can use this unified data model to build personalization, inform decisions, and optimize campaigns based on measurable metrics.

Centralized management lets teams across marketing, asset management, and customer service deploy, track, and refine QR Codes and short links consistently across all regions. With Bitly, you can scale personalization initiatives securely while maintaining regulatory compliance.

Explore the future of personalization in financial services

Personalization powered by scan and click data gives financial institutions the competitive edge they need to thrive in today’s financial services industry. By using real-time engagement metrics from QR Codes and short links, firms can understand customer needs to deliver tailored digital experiences that drive stronger customer engagement.

Secure and compliant data management remains the foundation of this transformation. Providers must rely on platforms that protect customer data, support automation, and ensure regulatory compliance. Bitly delivers all of this as your enterprise-ready partner for SOC-2–compliant personalization.

Build trust, enhance personalization, and future-proof your customer experience with Bitly. Sign up today to put the power of personal targeting to work on your behalf.